Your monthly payment includes your mortgage payment consisting of principal and interest as well as property taxes and homeowners insurance. Most mortgage lenders calculate monthly fees by.

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

If you qualify for a 50000.

. Property taxes are included as part of your monthly mortgage payment. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any outstanding property taxes. Your property taxes are due once yearly.

A mortgage lien is a claim to your property until you make good on your liability in this case property taxes. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. If your county tax rate is 1 your property tax bill will come out to.

If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment. There are other cases where a 400000 subject property. Assessments On Property Taxes In Mortgage Qualification.

There are cases where a 100000 home has property taxes. Lets say your home has an assessed value of 200000. When calculating a new mortgage where you know approximately your annual taxes and insurance.

The mortgage the homebuyer pays one year can increase the following year if property taxes increase. If you dont pay your taxes the county can put a lien on your. Property taxes are included in mortgage payments for most homeowners.

An essential cost of home ownership property taxes are due. Do you pay property taxes monthly. Your mortgage payment is.

Lets say your home has an assessed value of 200000. Thats 167 per month if your property. Your property taxes are included in your monthly home loan payments.

How Are Property Taxes Paid. You pay your property taxes with your monthly mortgage payment if you choose escrow during the loan financing process. PITI is typically quoted on.

The inclusion of property taxes in mortgage payments can make for a higher. First-time homebuyers can benefit from having their real estate property taxes paid with their home loan each month. Specifically they consist of the principal amount loan interest property tax and the homeowners insurance and private mortgage insurance premiums.

Your property taxes are included in your monthly home loan payments. If you get a home loan. Are Property Taxes Included In Mortgage Payments.

With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a. Specifically they consist of the principal amount loan interest property tax and the homeowners insurance and private mortgage insurance premiums. Assessed Value x Property Tax Rate Property Tax.

According to SFGATE most homeowners pay their property taxes through their monthly payments to. If your county tax rate is 1 your property tax bill will come out to 2000 per year. The answer to that usually is yes.

Property tax is included in most mortgage payments. PITI is typically quoted on a. So if you make your monthly mortgage payments on time then youre probably already paying.

Do you pay property taxes monthly or yearly.

Check Mortgage Loan Property Types Areas For Mortgage Loan

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

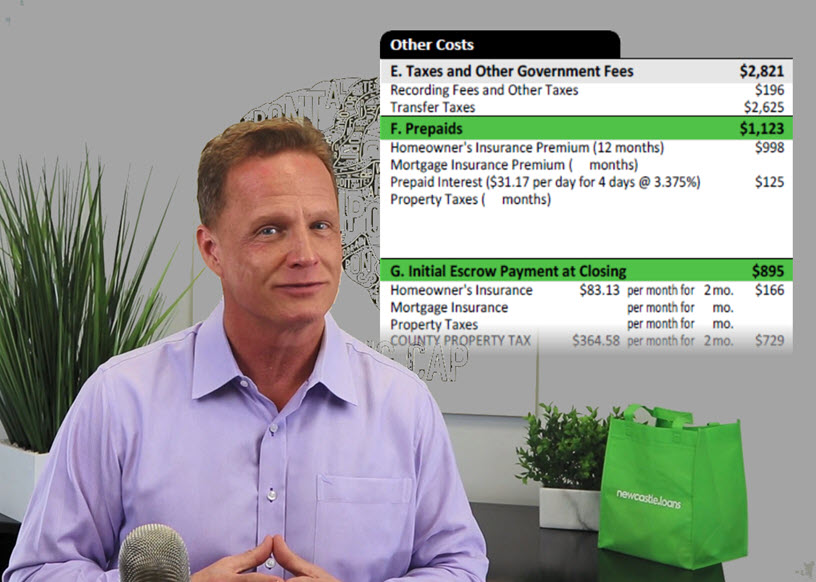

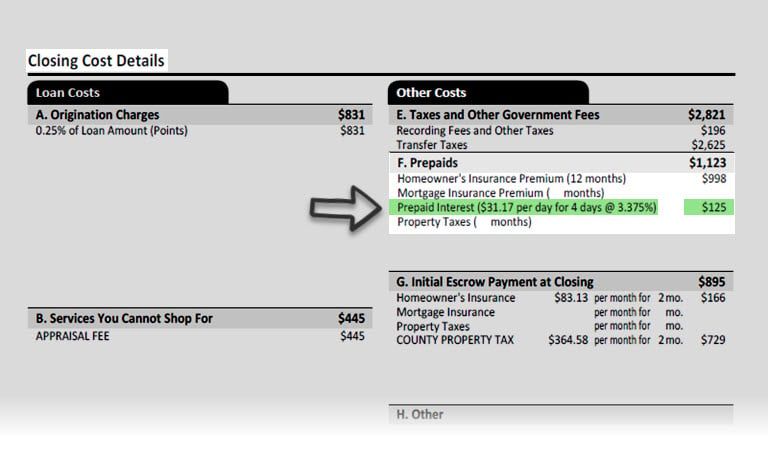

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Deducting Property Taxes H R Block

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

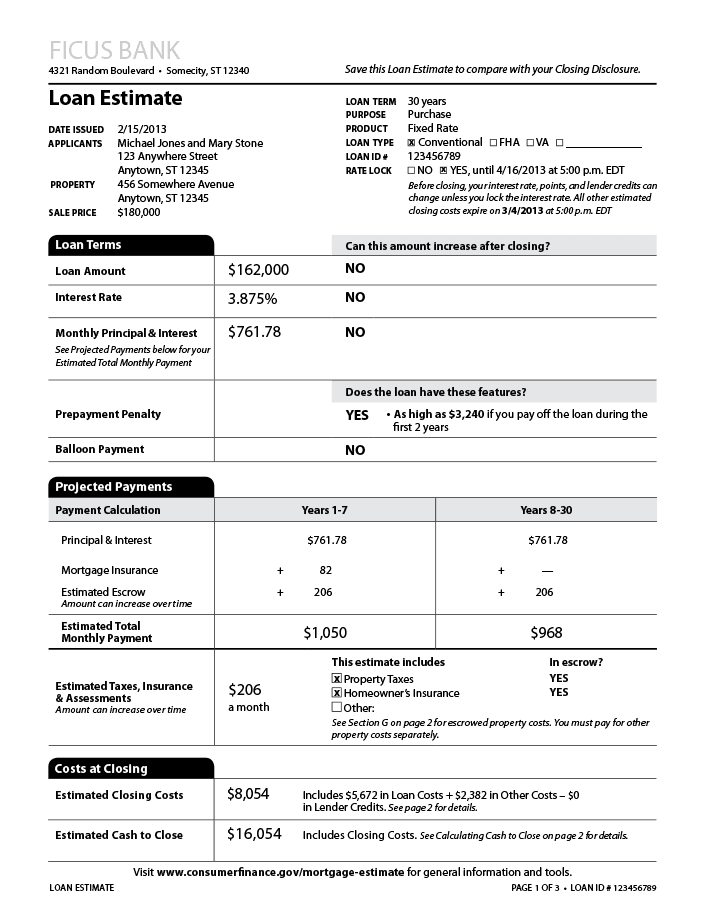

Loan Estimate Explainer Consumer Financial Protection Bureau

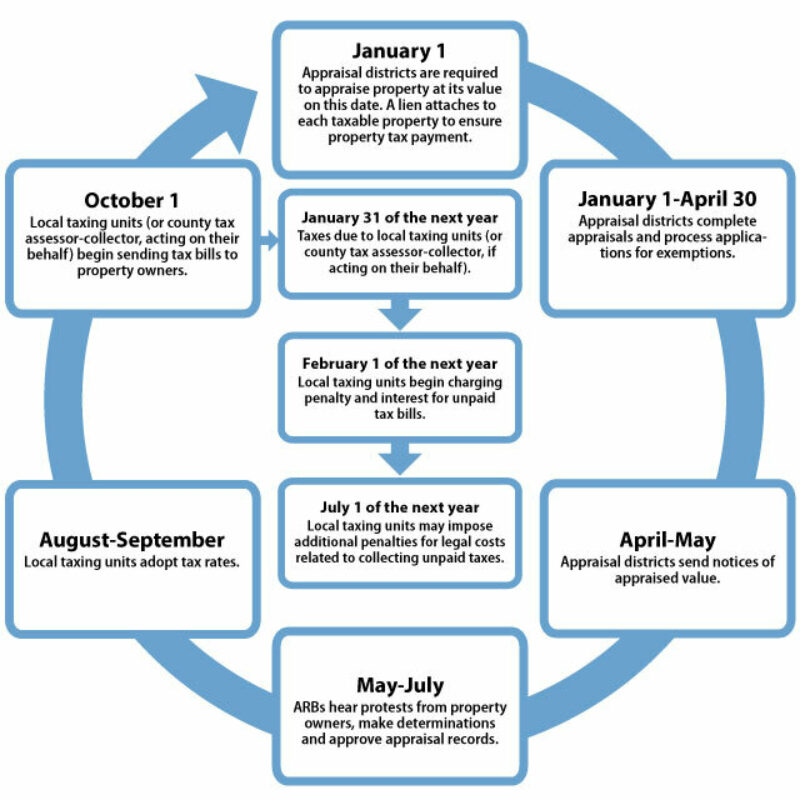

All About Property Taxes When Why And How Texans Pay

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

What Am I Paying For With My Monthly Mortgage Payment

Property Taxes What Are They How To Calculate Bankrate

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Countries Without Property Tax In 2022 Adam Fayed

![]()

Property Taxes Included With Monthly Mortgage Payment R Personalfinancecanada

Mortgage The Components Of A Mortgage Payment Wells Fargo

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service